Page 60 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 60

46 The Complete Guide to Executive Compensation

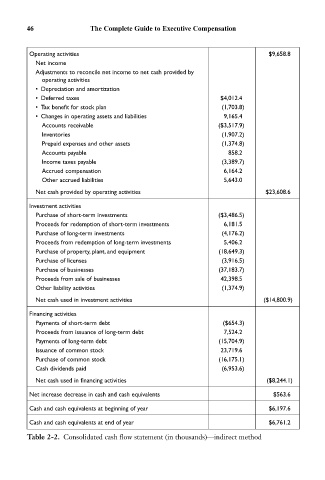

Operating activities $9,658.8

Net income

Adjustments to reconcile net income to net cash provided by

operating activities

• Depreciation and amortization

• Deferred taxes $4,012.4

• Tax benefit for stock plan (1,703.8)

• Changes in operating assets and liabilities 9,165.4

Accounts receivable ($3,517.9)

Inventories (1,907.2)

Prepaid expenses and other assets (1,374.8)

Accounts payable 858.2

Income taxes payable (3,389.7)

Accrued compensation 6,164.2

Other accrued liabilities 5,643.0

Net cash provided by operating activities $23,608.6

Investment activities

Purchase of short-term investments ($3,486.5)

Proceeds for redemption of short-term investments 6,181.5

Purchase of long-term investments (4,176.2)

Proceeds from redemption of long-term investments 5,406.2

Purchase of property, plant, and equipment (18,649.3)

Purchase of licenses (3,916.5)

Purchase of businesses (37,183.7)

Proceeds from sale of businesses 42,398.5

Other liability activities (1,374.9)

Net cash used in investment activities ($14,800.9)

Financing activities

Payments of short-term debt ($654.3)

Proceeds from issuance of long-term debt 7,524.2

Payments of long-term debt (15,704.9)

Issuance of common stock 23,719.6

Purchase of common stock (16,175.1)

Cash dividends paid (6,953.6)

Net cash used in financing activities ($8,244.1)

Net increase decrease in cash and cash equivalents $563.6

Cash and cash equivalents at beginning of year $6,197.6

Cash and cash equivalents at end of year $6,761.2

Table 2-2. Consolidated cash flow statement (in thousands)—indirect method