Page 59 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 59

Chapter 2. Performance Measurements and Standards 45

the income statement. A company will record a sale when it is delivered to a customer, but

since few customers pay cash at that precise moment, there is a time lag before a company

receives the cash. Additionally, the company may have investing and financing activities. The

cash flow statement is thus a report of the cash received and spent during the business year.

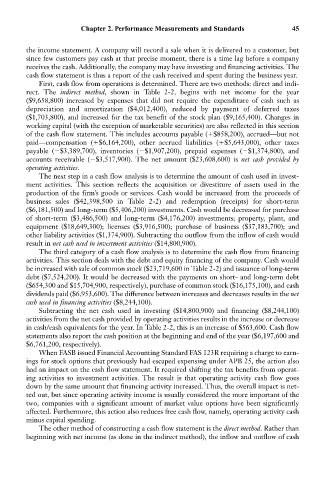

First, cash flow from operations is determined. There are two methods: direct and indi-

rect. The indirect method, shown in Table 2-2, begins with net income for the year

($9,658,800) increased by expenses that did not require the expenditure of cash such as

depreciation and amortization ($4,012,400), reduced by payment of deferred taxes

($1,703,800), and increased for the tax benefit of the stock plan ($9,165,400). Changes in

working capital (with the exception of marketable securities) are also reflected in this section

of the cash flow statement. This includes accounts payable ( $858,200), accrued—but not

paid—compensation ( $6,164,200), other accrued liabilities ( $5,643,000), other taxes

payable ( $3,389,700), inventories ( $1,907,200), prepaid expenses ( $1,374,800), and

accounts receivable ( $3,517,900). The net amount ($23,608,600) is net cash provided by

operating activities.

The next step in a cash flow analysis is to determine the amount of cash used in invest-

ment activities. This section reflects the acquisition or divestiture of assets used in the

production of the firm’s goods or services. Cash would be increased from the proceeds of

business sales ($42,398,500 in Table 2-2) and redemption (receipts) for short-term

($6,181,500) and long-term ($5,406,200) investments. Cash would be decreased for purchase

of short-term ($3,486,500) and long-term ($4,176,200) investments; property, plant, and

equipment ($18,649,300); licenses ($3,916,500); purchase of business ($37,183,700); and

other liability activities ($1,374,900). Subtracting the outflow from the inflow of cash would

result in net cash used in investment activities ($14,800,900).

The third category of a cash flow analysis is to determine the cash flow from financing

activities. This section deals with the debt and equity financing of the company. Cash would

be increased with sale of common stock ($23,719,600 in Table 2-2) and issuance of long-term

debt ($7,524,200). It would be decreased with the payments on short- and long-term debt

($654,300 and $15,704,900, respectively), purchase of common stock ($16,175,100), and cash

dividends paid ($6,953,600). The difference between increases and decreases results in the net

cash used in financing activities ($8,244,100).

Subtracting the net cash used in investing ($14,800,900) and financing ($8,244,100)

activities from the net cash provided by operating activities results in the increase or decrease

in cash/cash equivalents for the year. In Table 2-2, this is an increase of $563,600. Cash flow

statements also report the cash position at the beginning and end of the year ($6,197,600 and

$6,761,200, respectively).

When FASB issued Financial Accounting Standard FAS 123R requiring a charge to earn-

ings for stock options that previously had escaped expensing under APB 25, the action also

had an impact on the cash flow statement. It required shifting the tax benefits from operat-

ing activities to investment activities. The result is that operating activity cash flow goes

down by the same amount that financing activity increased. Thus, the overall impact is net-

ted out, but since operating activity income is usually considered the more important of the

two, companies with a significant amount of market value options have been significantly

affected. Furthermore, this action also reduces free cash flow, namely, operating activity cash

minus capital spending.

The other method of constructing a cash flow statement is the direct method. Rather than

beginning with net income (as done in the indirect method), the inflow and outflow of cash