Page 182 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 182

160 CHAPTER 5

Abercorn Common are the costs one might typically associate with pioneering efforts

that are compensated for by first-mover advantage.

So what of those early benefits? Like some of the more intangible aspects of cost-

ing the LEED premium, while we realize that we have benefited by our pioneering

efforts at Abercorn Common, it is hard to put a hard dollar number on them. Did the

time it took to lease the center at some point become easier as a result of the green

brand we were creating? We believe it did, though we lack a benchmark to compare it

to. Did we see an increase in the rental rates we were able to negotiate over the time

of the development? In fact, we did see an increase, with initial rental rates negotiated

in the $15- to $17-per-square foot range, and later rental rates realized in the $35-per-

square-foot range. But how much of that increase is simply attributable to the market

getting comfortable that a development on paper was becoming a reality, how much

to the fact that vacant space was becoming more limited, and how much to the green

brand of Abercorn Common? Anecdotally, we feel that the green brand was a small

contributing factor to the up-tick in rents—and even a small portion of a 100 percent

increase in gross income is significant. However, since we don’t feel comfortable

assigning a percentage benefit, we will leave it out of our analysis. We did see an over-

all increase in the valuation of Abercorn as part of our refinancing of an entire green

portfolio. That increase is factored into our analysis in Chapter 4.

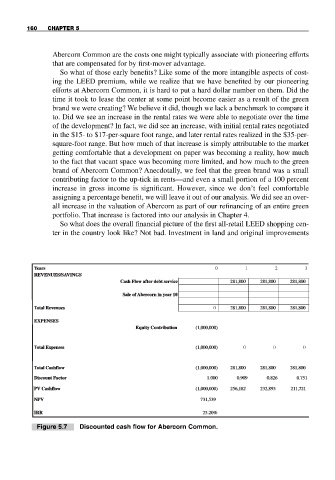

So what does the overall financial picture of the first all-retail LEED shopping cen-

ter in the country look like? Not bad. Investment in land and original improvements

Y Years 0 1 2 3

ears

REVENUES/SAVINGS

REVENUES/SA VINGS

after

Cash

Cash Flow after debt service 281,800 281,800 281,800

281,800

Flow

281,800

281,800

debt

service

Sale of Abercorn in year 1010

Sale of Aber c o r ni ny e a r

281,800

281,800

Total Revenuesotal Revenues 0 281,800 281,800 281,800

281,800

EXPENSES

EXPENSES

(1,000,000)

Equity Contribution

Equity Contribution (1,000,000)

(1,000,000)

Total Expensesotal Expenses (1,000,000) 0 0 0

(1,000,000)

281,800

281,800

281,800

Total Cashflowotal Cashflow (1,000,000) 281,800 281,800 281,800

Discount Factor 1.000 0.909 0.826 0.751

1.000

0.909

Discount Factor

0.826

0.751

232,893

Cashflow

256,182

PV

PV Cashflow (1,000,000) 256,182 232,893 211,721

(1,000,000)

21

1,721

NPV

NPV 731,539

731,539

25.20%

IRR

IRR 25.20%

Figure 5.7 Discounted cash flow for Abercorn Common.