Page 57 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 57

36 CHAPTER 1

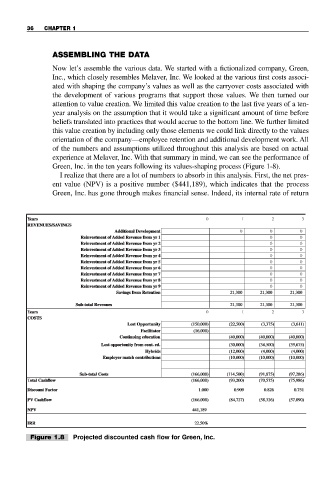

ASSEMBLING THE DATA

Now let’s assemble the various data. We started with a fictionalized company, Green,

Inc., which closely resembles Melaver, Inc. We looked at the various first costs associ-

ated with shaping the company’s values as well as the carryover costs associated with

the development of various programs that support those values. We then turned our

attention to value creation. We limited this value creation to the last five years of a ten-

year analysis on the assumption that it would take a significant amount of time before

beliefs translated into practices that would accrue to the bottom line. We further limited

this value creation by including only those elements we could link directly to the values

orientation of the company—employee retention and additional development work. All

of the numbers and assumptions utilized throughout this analysis are based on actual

experience at Melaver, Inc. With that summary in mind, we can see the performance of

Green, Inc. in the ten years following its values-shaping process (Figure 1-8).

I realize that there are a lot of numbers to absorb in this analysis. First, the net pres-

ent value (NPV) is a positive number ($441,189), which indicates that the process

Green, Inc. has gone through makes financial sense. Indeed, its internal rate of return

Y Years 0 1 2 3

ears

REVENUES/SAVINGS

REVENUES/SA VINGS

Additional

Development

Additional Development 0 0 0

Reinvestment of Added Revenue fr om yr 1 0 0

Reinvestment of Added Revenue from yr 1

Reinvestment of Added Revenue from yr 2

Reinvestment of Added Revenue fr om yr 2 0 0

Reinvestment of Added Revenue from yr 3 3 0 0

Revenue

fr

of

Reinvestment

Added

yr

om

Reinvestment of Added Revenue from yr 4 4 0 0

Added

Revenue

fr

yr

of

om

Reinvestment

Reinvestment

of

om

Added

Reinvestment of Added Revenue from yr 5 5 0 0

Revenue

yr

fr

Reinvestment of Added Revenue from yr 6

Reinvestment of Added Revenue fr om yr 6 0 0

fr

om

of

Revenue

Reinvestment

Added

yr

Reinvestment of Added Revenue from yr 7 7 0 0

Added

Revenue

of

yr

Reinvestment

Reinvestment of Added Revenue from yr 8 8 0 0

fr

om

Added

om

fr

Revenue

Reinvestment of Added Revenue from yr 9 9 0 0

Reinvestment

of

yr

Retention

21,300

om

21,300

21,300

fr

Savings

Savings from Retention 21,300 21,300 21,300

Sub-total Revenues

Sub-total Revenues 21,300 21,300 21,300

21,300

21,300

21,300

Years 0 1 2 3

ears

COSTS

COSTS

Lost Opportunity

1)

(3,61

(3,375)

(22,500)

(150,000)

Lost Opportunity (150,000) (22,500) (3,375) (3,611)

Facilitator (16,000)

Facilitator

(16,000)

(40,000)

education

(40,000)

Continuing education (40,000) (40,000) (40,000)

(40,000)

Continuing

(34,500)

Lost opportunity from cont. ed.

Lost opportunity fr om cont. ed. (30,000) (34,500) (39,675)

(39,675)

(30,000)

Hybrids

Hybrids (12,000) (4,000) (4,000)

(12,000)

(4,000)

(4,000)

(10,000)

Employer match contributions

(10,000)

Employer match contributions (10,000) (10,000) (10,000)

(10,000)

14,500)

(91,875)

(97,286)

Sub-total Costs (166,000) (1 (114,500) (91,875) (97,286)

(166,000)

Sub-total

Costs

(75,986)

Total Cashflowotal Cashflow (166,000) (93,200) (70,575) (75,986)

(70,575)

(93,200)

(166,000)

Discount Factor

0.751

1.000

0.909

Discount Factor 1.000 0.909 0.826 0.751

0.826

(84,727)

(57,090)

Cashflow

(58,326)

(166,000)

PV

PV Cashflow (166,000) (84,727) (58,326) (57,090)

NPV 441,189

NPV

441,189

IRR

IRR 22.50%

22.50%

Figure 1.8 Projected discounted cash flow for Green, Inc.