Page 81 - Essentials of Payroll: Management and Accounting

P. 81

ESSENTIALS of Payr oll: Management and Accounting

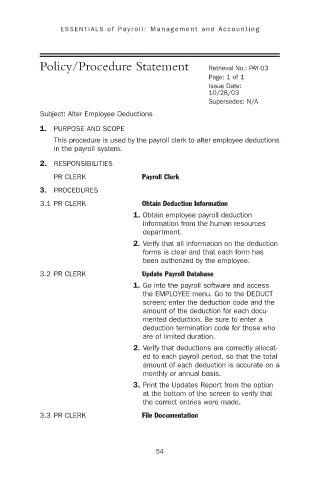

Policy/Procedure Statement Retrieval No.: PAY-03

Page: 1 of 1

Issue Date:

10/28/03

Supersedes: N/A

Subject: Alter Employee Deductions

1. PURPOSE AND SCOPE

This procedure is used by the payroll clerk to alter employee deductions

in the payroll system.

2. RESPONSIBILITIES

PR CLERK Payroll Clerk

3. PROCEDURES

3.1 PR CLERK Obtain Deduction Information

1. Obtain employee payroll deduction

information from the human resources

department.

2. Verify that all information on the deduction

forms is clear and that each form has

been authorized by the employee.

3.2 PR CLERK Update Payroll Database

1. Go into the payroll software and access

the EMPLOYEE menu. Go to the DEDUCT

screen; enter the deduction code and the

amount of the deduction for each docu-

mented deduction. Be sure to enter a

deduction termination code for those who

are of limited duration.

2. Verify that deductions are correctly allocat-

ed to each payroll period, so that the total

amount of each deduction is accurate on a

monthly or annual basis.

3. Print the Updates Report from the option

at the bottom of the screen to verify that

the correct entries were made.

3.3 PR CLERK File Documentation

54