Page 322 - Fundamentals of Gas Shale Reservoirs

P. 322

302 RESOURCE ESTIMATION FOR SHALE GAS RESERVOIRS

(a) (b)

Production ERR Production

Commercial Proved 1P Probable 2P Possible 3P Commercial Proved 1P Probable 2P Possible 3P

Reserves

Reserves

Discovered PIIP

Total oil and gas resource base (PIIP) Subcommercial 1C Unrecoverable 3C Increasing chance of commerciality Total oil and gas resource base Technically recoverable Sub-economical Undiscovered 1C Prospective 3C Increasing chance of commerciality

Contingent

Contingent

resources

resources

2C

2C

resources

Best

Undiscovered PIIP Low Prospective High OGIP TRR unrecoverable Low Discovered High

resources

Technically

Best

Undiscovered

Unrecoverable

Range of uncertainty Range of uncertainty

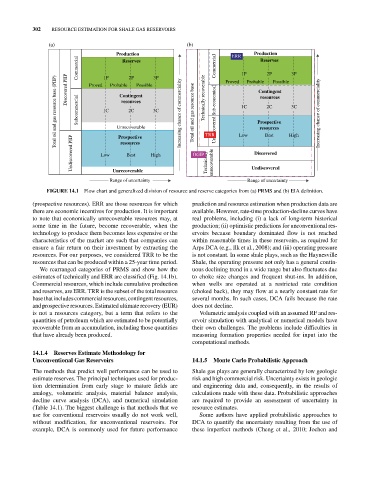

FIGURE 14.1 Flow chart and generalized division of resource and reserve categories from (a) PRMS and (b) EIA definition.

(prospective resources). ERR are those resources for which prediction and resource estimation when production data are

there are economic incentives for production. It is important available. However, rate‐time production‐decline curves have

to note that economically unrecoverable resources may, at real problems, including (i) a lack of long‐term historical

some time in the future, become recoverable, when the production; (ii) optimistic predictions for unconventional res-

technology to produce them becomes less expensive or the ervoirs because boundary dominated flow is not reached

characteristics of the market are such that companies can within reasonable times in these reservoirs, as required for

ensure a fair return on their investment by extracting the Arps DCA (e.g., Ilk et al., 2008); and (iii) operating pressure

resources. For our purposes, we considered TRR to be the is not constant. In some shale plays, such as the Haynesville

resources that can be produced within a 25‐year time period. Shale, the operating pressure not only has a general contin-

We rearranged categories of PRMS and show how the uous declining trend in a wide range but also fluctuates due

estimates of technically and ERR are classified (Fig. 14.1b). to choke size changes and frequent shut‐ins. In addition,

Commercial resources, which include cumulative production when wells are operated at a restricted rate condition

and reserves, are ERR. TRR is the subset of the total resource (choked back), they may flow at a nearly constant rate for

base that includes commercial resources, contingent resources, several months. In such cases, DCA fails because the rate

and prospective resources. Estimated ultimate recovery (EUR) does not decline.

is not a resources category, but a term that refers to the Volumetric analysis coupled with an assumed RF and res-

quantities of petroleum which are estimated to be potentially ervoir simulation with analytical or numerical models have

recoverable from an accumulation, including those quantities their own challenges. The problems include difficulties in

that have already been produced. measuring formation properties needed for input into the

computational methods.

14.1.4 Reserves Estimate Methodology for

Unconventional Gas Reservoirs 14.1.5 Monte Carlo Probabilistic Approach

The methods that predict well performance can be used to Shale gas plays are generally characterized by low geologic

estimate reserves. The principal techniques used for produc- risk and high commercial risk. Uncertainty exists in geologic

tion determination from early stage to mature fields are and engineering data and, consequently, in the results of

analogy, volumetric analysis, material balance analysis, calculations made with these data. Probabilistic approaches

decline curve analysis (DCA), and numerical simulation are required to provide an assessment of uncertainty in

(Table 14.1). The biggest challenge is that methods that we resource estimates.

use for conventional reservoirs usually do not work well, Some authors have applied probabilistic approaches to

without modification, for unconventional reservoirs. For DCA to quantify the uncertainty resulting from the use of

example, DCA is commonly used for future performance these imperfect methods (Cheng et al., 2010; Jochen and