Page 283 - Microsensors, MEMS and Smart Devices - Gardner Varadhan and Awadelkarim

P. 283

MECHANICAL SENSORS 263

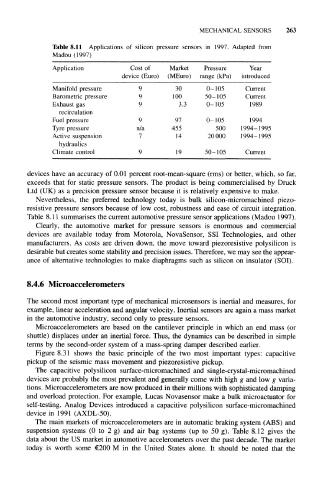

Table 8.11 Applications of silicon pressure sensors in 1997. Adapted from

Madou (1997)

Application Cost of Market Pressure Year

device (Euro) (MEuro) range (kPa) introduced

Manifold pressure 9 30 0-105 Current

Barometric pressure 9 100 50-105 Current

Exhaust gas 9 3.3 0-105 1989

recirculation

Fuel pressure 9 97 0-105 1994

Tyre pressure n/a 455 500 1994-1995

Active suspension 7 14 20000 1994-1995

hydraulics

Climate control 9 19 50-105 Current

devices have an accuracy of 0.01 percent root-mean-square (rms) or better, which, so far,

exceeds that for static pressure sensors. The product is being commercialised by Druck

Ltd (UK) as a precision pressure sensor because it is relatively expensive to make.

Nevertheless, the preferred technology today is bulk silicon-micromachined piezo-

resistive pressure sensors because of low cost, robustness and ease of circuit integration.

Table 8.11 summarises the current automotive pressure sensor applications (Madou 1997).

Clearly, the automotive market for pressure sensors is enormous and commercial

devices are available today from Motorola, NovaSensor, SSI Technologies, and other

manufacturers. As costs are driven down, the move toward piezoresistive polysilicon is

desirable but creates some stability and precision issues. Therefore, we may see the appear-

ance of alternative technologies to make diaphragms such as silicon on insulator (SOI).

8.4.6 Microaccelerometers

The second most important type of mechanical microsensors is inertial and measures, for

example, linear acceleration and angular velocity. Inertial sensors are again a mass market

in the automotive industry, second only to pressure sensors.

Microaccelerometers are based on the cantilever principle in which an end mass (or

shuttle) displaces under an inertial force. Thus, the dynamics can be described in simple

terms by the second-order system of a mass-spring damper described earlier.

Figure 8.31 shows the basic principle of the two most important types: capacitive

pickup of the seismic mass movement and piezoresistive pickup.

The capacitive polysilicon surface-micromachined and single-crystal-micromachined

devices are probably the most prevalent and generally come with high g and low g varia-

tions. Microaccelerometers are now produced in their millions with sophisticated damping

and overload protection. For example, Lucas Novasensor make a bulk microactuator for

self-testing. Analog Devices introduced a capacitive polysilicon surface-micromachined

device in 1991 (AXDL-50).

The main markets of microaccelerorneters are in automatic braking system (ABS) and

suspension systems (0 to 2 g) and air bag systems (up to 50 g). Table 8.12 gives the

data about the US market in automotive accelerometers over the past decade. The market

today is worth some €200 M in the United States alone. It should be noted that the