Page 335 - Solid Waste Analysis and Minimization a Systems Approach

P. 335

COST-BENEFIT ANALYSIS CASE STUDY 313

19.5 Cost-Benefit Analysis Case Study

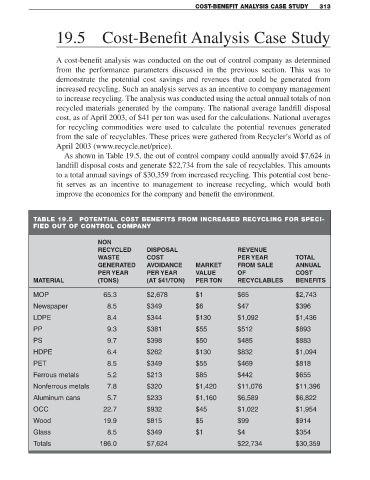

A cost-benefit analysis was conducted on the out of control company as determined

from the performance parameters discussed in the previous section. This was to

demonstrate the potential cost savings and revenues that could be generated from

increased recycling. Such an analysis serves as an incentive to company management

to increase recycling. The analysis was conducted using the actual annual totals of non

recycled materials generated by the company. The national average landfill disposal

cost, as of April 2003, of $41 per ton was used for the calculations. National averages

for recycling commodities were used to calculate the potential revenues generated

from the sale of recyclables. These prices were gathered from Recycler’s World as of

April 2003 (www.recycle.net/price).

As shown in Table 19.5, the out of control company could annually avoid $7,624 in

landfill disposal costs and generate $22,734 from the sale of recyclables. This amounts

to a total annual savings of $30,359 from increased recycling. This potential cost bene-

fit serves as an incentive to management to increase recycling, which would both

improve the economics for the company and benefit the environment.

TABLE 19.5 POTENTIAL COST BENEFITS FROM INCREASED RECYCLING FOR SPECI-

FIED OUT OF CONTROL COMPANY

NON

RECYCLED DISPOSAL REVENUE

WASTE COST PER YEAR TOTAL

GENERATED AVOIDANCE MARKET FROM SALE ANNUAL

PER YEAR PER YEAR VALUE OF COST

MATERIAL (TONS) (AT $41/TON) PER TON RECYCLABLES BENEFITS

MOP 65.3 $2,678 $1 $65 $2,743

Newspaper 8.5 $349 $6 $47 $396

LDPE 8.4 $344 $130 $1,092 $1,436

PP 9.3 $381 $55 $512 $893

PS 9.7 $398 $50 $485 $883

HDPE 6.4 $262 $130 $832 $1,094

PET 8.5 $349 $55 $469 $818

Ferrous metals 5.2 $213 $85 $442 $655

Nonferrous metals 7.8 $320 $1,420 $11,076 $11,396

Aluminum cans 5.7 $233 $1,160 $6,589 $6,822

OCC 22.7 $932 $45 $1,022 $1,954

Wood 19.9 $815 $5 $99 $914

Glass 8.5 $349 $1 $4 $354

Totals 186.0 $7,624 $22,734 $30,359