Page 223 -

P. 223

CHAPTER 6 • STRATEGY ANALYSIS AND CHOICE 189

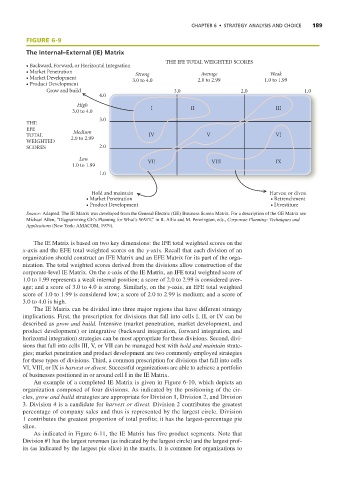

FIGURE 6-9

The Internal–External (IE) Matrix

THE IFE TOTAL WEIGHTED SCORES

• Backward, Forward, or Horizontal Integration

• Market Penetration Strong Average Weak

• Market Development 3.0 to 4.0 2.0 to 2.99 1.0 to 1.99

• Product Development

Grow and build 3.0 2.0 1.0

4.0

High

3.0 to 4.0 I II III

3.0

THE

EFE Medium

TOTAL 2.0 to 2.99 IV V VI

WEIGHTED

SCORES 2.0

Low

1.0 to 1.99 VII VIII IX

1.0

Hold and maintain Harvest or divest

• Market Penetration • Retrenchment

• Product Development • Divestiture

Source: Adapted. The IE Matrix was developed from the General Electric (GE) Business Screen Matrix. For a description of the GE Matrix see

Michael Allen, “Diagramming GE’s Planning for What’s WATT,” in R. Allio and M. Pennington, eds., Corporate Planning: Techniques and

Applications (New York: AMACOM, 1979).

The IE Matrix is based on two key dimensions: the IFE total weighted scores on the

x-axis and the EFE total weighted scores on the y-axis. Recall that each division of an

organization should construct an IFE Matrix and an EFE Matrix for its part of the orga-

nization. The total weighted scores derived from the divisions allow construction of the

corporate-level IE Matrix. On the x-axis of the IE Matrix, an IFE total weighted score of

1.0 to 1.99 represents a weak internal position; a score of 2.0 to 2.99 is considered aver-

age; and a score of 3.0 to 4.0 is strong. Similarly, on the y-axis, an EFE total weighted

score of 1.0 to 1.99 is considered low; a score of 2.0 to 2.99 is medium; and a score of

3.0 to 4.0 is high.

The IE Matrix can be divided into three major regions that have different strategy

implications. First, the prescription for divisions that fall into cells I, II, or IV can be

described as grow and build. Intensive (market penetration, market development, and

product development) or integrative (backward integration, forward integration, and

horizontal integration) strategies can be most appropriate for these divisions. Second, divi-

sions that fall into cells III, V, or VII can be managed best with hold and maintain strate-

gies; market penetration and product development are two commonly employed strategies

for these types of divisions. Third, a common prescription for divisions that fall into cells

VI, VIII, or IX is harvest or divest. Successful organizations are able to achieve a portfolio

of businesses positioned in or around cell I in the IE Matrix.

An example of a completed IE Matrix is given in Figure 6-10, which depicts an

organization composed of four divisions. As indicated by the positioning of the cir-

cles, grow and build strategies are appropriate for Division 1, Division 2, and Division

3. Division 4 is a candidate for harvest or divest. Division 2 contributes the greatest

percentage of company sales and thus is represented by the largest circle. Division

1 contributes the greatest proportion of total profits; it has the largest-percentage pie

slice.

As indicated in Figure 6-11, the IE Matrix has five product segments. Note that

Division #1 has the largest revenues (as indicated by the largest circle) and the largest prof-

its (as indicated by the largest pie slice) in the matrix. It is common for organizations to