Page 447 -

P. 447

CASE 4 • AIRTRAN AIRWAYS, INC. — 2009 43

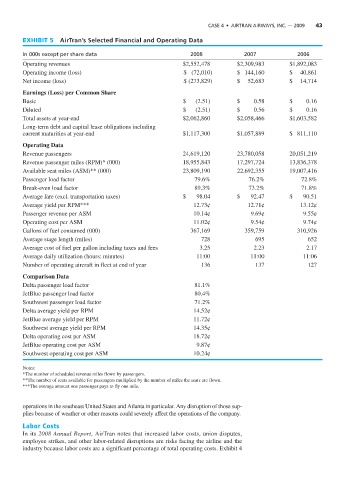

EXHIBIT 5 AirTran’s Selected Financial and Operating Data

In 000s except per share data 2008 2007 2006

Operating revenues $2,552,478 $2,309,983 $1,892,083

Operating income (loss) $ (72,010) $ 144,160 $ 40,861

Net income (loss) $ (273,829) $ 52,683 $ 14,714

Earnings (Loss) per Common Share

Basic $ (2.51) $ 0.58 $ 0.16

Diluted $ (2.51) $ 0.56 $ 0.16

Total assets at year-end $2,062,860 $2,058,466 $1,603,582

Long-term debt and capital lease obligations including

current maturities at year-end $1,117,300 $1,057,889 $ 811,110

Operating Data

Revenue passengers 24,619,120 23,780,058 20,051,219

Revenue passenger miles (RPM)* (000) 18,955,843 17,297,724 13,836,378

Available seat miles (ASM)** (000) 23,809,190 22,692,355 19,007,416

Passenger load factor 79.6% 76.2% 72.8%

Break-even load factor 89.3% 73.2% 71.8%

Average fare (excl. transportation taxes) $ 98.04 $ 92.47 $ 90.51

Average yield per RPM*** 12.73¢ 12.71¢ 13.12¢

Passenger revenue per ASM 10.14¢ 9.69¢ 9.55¢

Operating cost per ASM 11.02¢ 9.54¢ 9.74¢

Gallons of fuel consumed (000) 367,169 359,759 310,926

Average stage length (miles) 728 695 652

Average cost of fuel per gallon including taxes and fees 3.25 2.23 2.17

Average daily utilization (hours: minutes) 11:00 11:00 11:06

Number of operating aircraft in fleet at end of year 136 137 127

Comparison Data

Delta passenger load factor 81.1%

JetBlue passenger load factor 80.4%

Southwest passenger load factor 71.2%

Delta average yield per RPM 14.52¢

JetBlue average yield per RPM 11.72¢

Southwest average yield per RPM 14.35¢

Delta operating cost per ASM 18.72¢

JetBlue operating cost per ASM 9.87¢

Southwest operating cost per ASM 10.24¢

Notes:

*The number of scheduled revenue miles flown by passengers.

**The number of seats available for passengers multiplied by the number of miles the seats are flown.

***The average amount one passenger pays to fly one mile.

operations in the southeast United States and Atlanta in particular. Any disruption of those sup-

plies because of weather or other reasons could severely affect the operations of the company.

Labor Costs

In its 2008 Annual Report, AirTran notes that increased labor costs, union disputes,

employee strikes, and other labor-related disruptions are risks facing the airline and the

industry because labor costs are a significant percentage of total operating costs. Exhibit 4