Page 521 -

P. 521

CASE 11 • WELLS FARGO CORPORATION — 2009 117

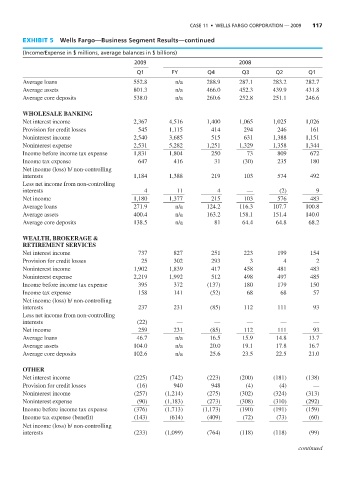

EXHIBIT 5 Wells Fargo—Business Segment Results—continued

(Income/Expense in $ millions, average balances in $ billions)

2009 2008

Q1 FY Q4 Q3 Q2 Q1

Average loans 552.8 n/a 288.9 287.1 283.2 282.7

Average assets 801.3 n/a 466.0 452.3 439.9 431.8

Average core deposits 538.0 n/a 260.6 252.8 251.1 246.6

WHOLESALE BANKING

Net interest income 2,367 4,516 1,400 1,065 1,025 1,026

Provision for credit losses 545 1,115 414 294 246 161

Noninterest income 2,540 3,685 515 631 1,388 1,151

Noninterest expense 2,531 5,282 1,251 1,329 1,358 1,344

Income before income tax expense 1,831 1,804 250 73 809 672

Income tax expense 647 416 31 (30) 235 180

Net income (loss) b/ non-controlling

interests 1,184 1,388 219 103 574 492

Less net income from non-controlling

interests 4 11 4 — (2) 9

Net income 1,180 1,377 215 103 576 483

Average loans 271.9 n/a 124.2 116.3 107.7 100.8

Average assets 400.4 n/a 163.2 158.1 151.4 140.0

Average core deposits 138.5 n/a 81 64.4 64.8 68.2

WEALTH, BROKERAGE &

RETIREMENT SERVICES

Net interest income 737 827 251 223 199 154

Provision for credit losses 25 302 293 3 4 2

Noninterest income 1,902 1,839 417 458 481 483

Noninterest expense 2,219 1,992 512 498 497 485

Income before income tax expense 395 372 (137) 180 179 150

Income tax expense 158 141 (52) 68 68 57

Net income (loss) b/ non-controlling

interests 237 231 (85) 112 111 93

Less net income from non-controlling

interests (22) — — — — —

Net income 259 231 (85) 112 111 93

Average loans 46.7 n/a 16.5 15.9 14.8 13.7

Average assets 104.0 n/a 20.0 19.1 17.8 16.7

Average core deposits 102.6 n/a 25.6 23.5 22.5 21.0

OTHER

Net interest income (225) (742) (223) (200) (181) (138)

Provision for credit losses (16) 940 948 (4) (4) —

Noninterest income (257) (1,214) (275) (302) (324) (313)

Noninterest expense (90) (1,183) (273) (308) (310) (292)

Income before income tax expense (376) (1,713) (1,173) (190) (191) (159)

Income tax expense (benefit) (143) (614) (409) (72) (73) (60)

Net income (loss) b/ non-controlling

interests (233) (1,099) (764) (118) (118) (99)

continued