Page 100 -

P. 100

ChaPter 3 • ProjeCt management 67

Annie’s Equipment Figure 3.10

70,000 Break-even analysis for a

Current proposed inventory system.

System

60,000

50,000

Break-Even

Point

40,000

Cost

($) Proposed

System

30,000

20,000

10,000

0

0 200 400 600 800 1,000 1,200

Units Sold

Cost of proposed Cost of current

system system

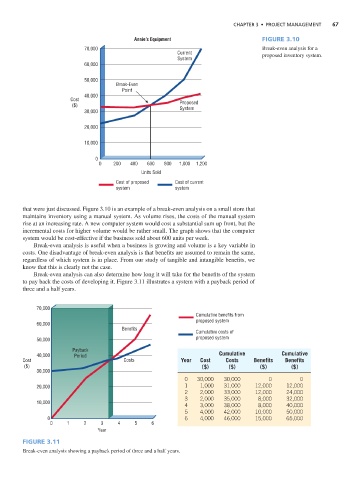

that were just discussed. Figure 3.10 is an example of a break-even analysis on a small store that

maintains inventory using a manual system. As volume rises, the costs of the manual system

rise at an increasing rate. A new computer system would cost a substantial sum up front, but the

incremental costs for higher volume would be rather small. The graph shows that the computer

system would be cost-effective if the business sold about 600 units per week.

Break-even analysis is useful when a business is growing and volume is a key variable in

costs. One disadvantage of break-even analysis is that benefits are assumed to remain the same,

regardless of which system is in place. From our study of tangible and intangible benefits, we

know that this is clearly not the case.

Break-even analysis can also determine how long it will take for the benefits of the system

to pay back the costs of developing it. Figure 3.11 illustrates a system with a payback period of

three and a half years.

70,000

Cumulative benefits from

proposed system

60,000

Benefits

Cumulative costs of

50,000 proposed system

Payback

40,000 Period Cumulative Cumulative

Cost Costs Year Cost Costs Benefits Benefits

($) ($) ($) ($) ($)

30,000

0 30,000 30,000 0 0

20,000 1 1,000 31,000 12,000 12,000

2 2,000 33,000 12,000 24,000

3 2,000 35,000 8,000 32,000

10,000

4 3,000 38,000 8,000 40,000

5 4,000 42,000 10,000 50,000

0 6 4,000 46,000 15,000 65,000

0 1 2 3 4 5 6

Year

Figure 3.11

Break-even analysis showing a payback period of three and a half years.