Page 101 -

P. 101

68 Part 1 • SyStemS analySiS FundamentalS

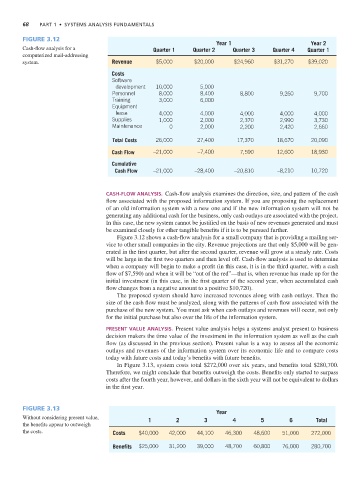

Figure 3.12

Year 1 Year 2

Cash-flow analysis for a Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 1

computerized mail-addressing

system. Revenue $5,000 $20,000 $24,960 $31,270 $39,020

Costs

Software

development 10,000 5,000

Personnel 8,000 8,400 8,800 9,260 9,700

Training 3,000 6,000

Equipment

lease 4,000 4,000 4,000 4,000 4,000

Supplies 1,000 2,000 2,370 2,990 3,730

Maintenance 0 2,000 2,200 2,420 2,660

Total Costs 26,000 27,400 17,370 18,670 20,090

Cash Flow –21,000 –7,400 7,590 12,600 18,930

Cumulative

Cash Flow –21,000 –28,400 –20,810 –8,210 10,720

CASH-FLOW ANALYSIS. Cash-flow analysis examines the direction, size, and pattern of the cash

flow associated with the proposed information system. If you are proposing the replacement

of an old information system with a new one and if the new information system will not be

generating any additional cash for the business, only cash outlays are associated with the project.

In this case, the new system cannot be justified on the basis of new revenues generated and must

be examined closely for other tangible benefits if it is to be pursued further.

Figure 3.12 shows a cash-flow analysis for a small company that is providing a mailing ser-

vice to other small companies in the city. Revenue projections are that only $5,000 will be gen-

erated in the first quarter, but after the second quarter, revenue will grow at a steady rate. Costs

will be large in the first two quarters and then level off. Cash-flow analysis is used to determine

when a company will begin to make a profit (in this case, it is in the third quarter, with a cash

flow of $7,590) and when it will be “out of the red”—that is, when revenue has made up for the

initial investment (in this case, in the first quarter of the second year, when accumulated cash

flow changes from a negative amount to a positive $10,720).

The proposed system should have increased revenues along with cash outlays. Then the

size of the cash flow must be analyzed, along with the patterns of cash flow associated with the

purchase of the new system. You must ask when cash outlays and revenues will occur, not only

for the initial purchase but also over the life of the information system.

PRESENT VALUE ANALYSIS. Present value analysis helps a systems analyst present to business

decision makers the time value of the investment in the information system as well as the cash

flow (as discussed in the previous section). Present value is a way to assess all the economic

outlays and revenues of the information system over its economic life and to compare costs

today with future costs and today’s benefits with future benefits.

In Figure 3.13, system costs total $272,000 over six years, and benefits total $280,700.

Therefore, we might conclude that benefits outweigh the costs. Benefits only started to surpass

costs after the fourth year, however, and dollars in the sixth year will not be equivalent to dollars

in the first year.

Figure 3.13

Year

Without considering present value, 1 2 3 4 5 6 Total

the benefits appear to outweigh

the costs. Costs $40,000 42,000 44,100 46,300 48,600 51,000 272,000

Benefits $25,000 31,200 39,000 48,700 60,800 76,000 280,700