Page 102 -

P. 102

ChaPter 3 • ProjeCt management 69

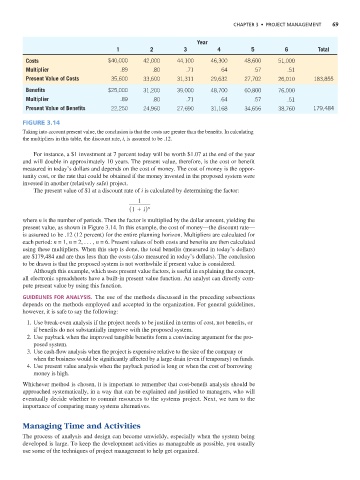

Year

1 2 3 4 5 6 Total

Costs $40,000 42,000 44,100 46,300 48,600 51,000

Multiplier .89 .80 .71 .64 .57 .51

Present Value of Costs 35,600 33,600 31,311 29,632 27,702 26,010 183,855

Benefits $25,000 31,200 39,000 48,700 60,800 76,000

Multiplier .89 .80 .71 .64 .57 .51

Present Value of Benefits 22,250 24,960 27,690 31,168 34,656 38,760 179,484

Figure 3.14

Taking into account present value, the conclusion is that the costs are greater than the benefits. In calculating

the multipliers in this table, the discount rate, i, is assumed to be .12.

For instance, a $1 investment at 7 percent today will be worth $1.07 at the end of the year

and will double in approximately 10 years. The present value, therefore, is the cost or benefit

measured in today’s dollars and depends on the cost of money. The cost of money is the oppor-

tunity cost, or the rate that could be obtained if the money invested in the proposed system were

invested in another (relatively safe) project.

The present value of $1 at a discount rate of i is calculated by determining the factor:

1

11 1 i2 n

where n is the number of periods. Then the factor is multiplied by the dollar amount, yielding the

present value, as shown in Figure 3.14. In this example, the cost of money—the discount rate—

is assumed to be .12 (12 percent) for the entire planning horizon. Multipliers are calculated for

each period: n = 1, n = 2, . . . , n = 6. Present values of both costs and benefits are then calculated

using these multipliers. When this step is done, the total benefits (measured in today’s dollars)

are $179,484 and are thus less than the costs (also measured in today’s dollars). The conclusion

to be drawn is that the proposed system is not worthwhile if present value is considered.

Although this example, which uses present value factors, is useful in explaining the concept,

all electronic spreadsheets have a built-in present value function. An analyst can directly com-

pute present value by using this function.

GUIDELINES FOR ANALYSIS. The use of the methods discussed in the preceding subsections

depends on the methods employed and accepted in the organization. For general guidelines,

however, it is safe to say the following:

1. Use break-even analysis if the project needs to be justified in terms of cost, not benefits, or

if benefits do not substantially improve with the proposed system.

2. Use payback when the improved tangible benefits form a convincing argument for the pro-

posed system.

3. Use cash-flow analysis when the project is expensive relative to the size of the company or

when the business would be significantly affected by a large drain (even if temporary) on funds.

4. Use present value analysis when the payback period is long or when the cost of borrowing

money is high.

Whichever method is chosen, it is important to remember that cost-benefit analysis should be

approached systematically, in a way that can be explained and justified to managers, who will

eventually decide whether to commit resources to the systems project. Next, we turn to the

importance of comparing many systems alternatives.

Managing Time and Activities

The process of analysis and design can become unwieldy, especially when the system being

developed is large. To keep the development activities as manageable as possible, you usually

use some of the techniques of project management to help get organized.