Page 329 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 329

Chapter 6. Employee Benefits and Perquisites 315

the first $96,000 of earnings, whereas the 1.45 percent Medicare tax is applied to all earnings.

The executive earning $100,000 pays about three times as much in social security as

Medicare, but for the executive earning $1,000,000, those ratios are reversed.

The $90,000 maximum taxable earnings base will be out of date shortly after this book

is published. Nonetheless, it is useful for purposes of illustrating how to calculate the pension

plan benefits with an excess formula.

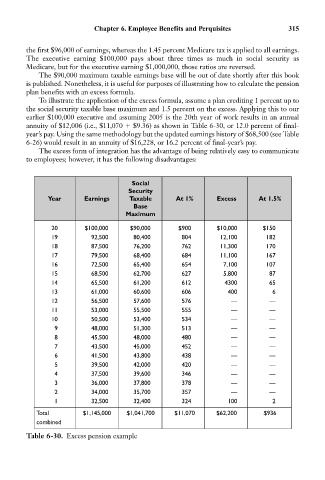

To illustrate the application of the excess formula, assume a plan crediting 1 percent up to

the social security taxable base maximum and 1.5 percent on the excess. Applying this to our

earlier $100,000 executive and assuming 2005 is the 20th year of work results in an annual

annuity of $12,006 (i.e., $11,070 $9.36) as shown in Table 6-30, or 12.0 percent of final-

year’s pay. Using the same methodology but the updated earnings history of $68,500 (see Table

6-26) would result in an annuity of $16,228, or 16.2 percent of final-year’s pay.

The excess form of integration has the advantage of being relatively easy to communicate

to employees; however, it has the following disadvantages:

Social

Security

Year Earnings Taxable At 1% Excess At 1.5%

Base

Maximum

20 $100,000 $90,000 $900 $10,000 $150

19 92,500 80,400 804 12,100 182

18 87,500 76,200 762 11,300 170

17 79,500 68,400 684 11,100 167

16 72,500 65,400 654 7,100 107

15 68,500 62,700 627 5,800 87

14 65,500 61,200 612 4300 65

13 61,000 60,600 606 400 6

12 56,500 57,600 576 — —

11 53,000 55,500 555 — —

10 50,500 53,400 534 — —

9 48,000 51,300 513 — —

8 45,500 48,000 480 — —

7 43,500 45,000 452 — —

6 41,500 43,800 438 — —

5 39,500 42,000 420 — —

4 37,500 39,600 346 — —

3 36,000 37,800 378 — —

2 34,000 35,700 357 — —

1 32,500 32,400 324 100 2

Total $1,145,000 $1,041,700 $11,070 $62,200 $936

combined

Table 6-30. Excess pension example