Page 565 -

P. 565

DECISION MAKING WITHOUT PROBABILITIES 545

Minimax Regret Approach

The minimax regret approach to decision making is neither purely optimistic nor

purely conservative. Let us illustrate the minimax regret approach by showing how it

can be used to select a decision alternative for the PDC problem.

Suppose that PDC constructs a small complex (d 1 ) and demand turns out to be

strong (s 1 ). Table 13.1 showed that the resulting profit for PDC would be R8 million.

However, given that the strong demand state of nature (s 1 ) has occurred, we realize

that the decision to construct a large condominium complex (d 3 ), yielding a profit of

R20 million, would have been the best decision. The difference between the payoff

for the best decision alternative (R20 million) and the payoff for the decision to

construct a small complex (R8 million) is the opportunity loss,or regret, associated

with decision alternative d 1 when state of nature s 1 occurs; so, for this case, the

opportunity loss or regret is R20 million R8 million ¼ R12 million. Similarly, if

PDC makes the decision to construct a medium complex (d 2 ) and the strong demand

state of nature (s 1 ) occurs, the opportunity loss, or regret, associated with d 2 would

be R20 million R14 million ¼ R6 million.

In general the following expression represents the opportunity loss, or regret.

R ij ¼jV V ij j (13:1)

j

where

R ij ¼ the regret associated with decision alternative s j

1

V ¼ the payoff value corresponding to the best decision for the state of nature s j

j

V ij ¼ the payoff corresponding to decision alternative d i and state of nature s j

Note the role of the absolute value in Equation (13.1) shown by the symbol ||. For

minimization problems, the best payoff, V , is the smallest entry in column j.Because

j

this value always is less than or equal to V ij , the absolute value of the difference between

V and V ij ensures that the regret is always the magnitude of the difference.

j

Using Equation (13.1) and the payoffs in Table 13.1, we can calculate the regret

associated with each combination of decision alternative d i and state of nature s j .

Because the PDC problem is a maximization problem, V will be the largest entry in

j

column j of the payoff table. Thus, to calculate the regret, we simply subtract each

entry in a column from the largest entry in the column. Table 13.4 shows the

opportunity loss, or regret, table for the PDC problem.

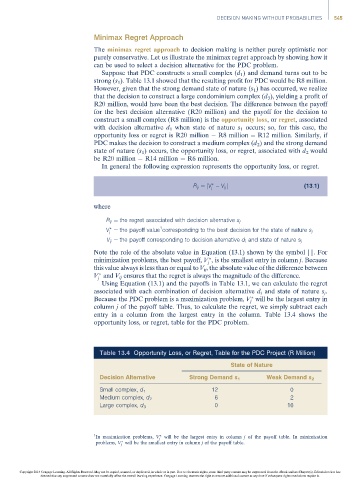

Table 13.4 Opportunity Loss, or Regret, Table for the PDC Project (R Million)

State of Nature

Decision Alternative Strong Demand s 1 Weak Demand s 2

12 0

Small complex, d 1

6 2

Medium complex, d 2

0 16

Large complex, d 3

1

In maximization problems, V j will be the largest entry in column j of the payoff table. In minimization

problems, V will be the smallest entry in column j of the payoff table.

j

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.