Page 603 -

P. 603

UTILITY AND DECISION MAKING 583

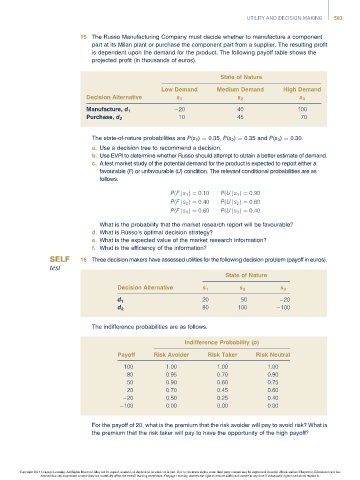

15 The Russo Manufacturing Company must decide whether to manufacture a component

part at its Milan plant or purchase the component part from a supplier. The resulting profit

is dependent upon the demand for the product. The following payoff table shows the

projected profit (in thousands of euros).

State of Nature

Low Demand Medium Demand High Demand

Decision Alternative s 1 s 2 s 3

20 40 100

Manufacture, d 1

Purchase, d 2 10 45 70

The state-of-nature probabilities are P(s 1 ) ¼ 0.35, P(s 2 ) ¼ 0.35 and P(s 3 ) ¼ 0.30.

a. Use a decision tree to recommend a decision.

b. Use EVPI to determine whether Russo should attempt to obtain a better estimate of demand.

c. A test market study of the potential demand for the product is expected to report either a

favourable (F)orunfavourable(U) condition. The relevant conditional probabilities are as

follows:

PðF j s 1 Þ¼ 0:10 PðU j s 1 Þ¼ 0:90

PðF j s 2 Þ¼ 0:40 PðU j s 2 Þ¼ 0:60

PðF j s 3 Þ¼ 0:60 PðU j s 3 Þ¼ 0:40

What is the probability that the market research report will be favourable?

d. What is Russo’s optimal decision strategy?

e. What is the expected value of the market research information?

f. What is the efficiency of the information?

16 Three decision makers have assessed utilities for the following decision problem (payoff in euros).

State of Nature

Decision Alternative s 1 s 2 s 3

20 50 20

d 1

80 100 100

d 2

The indifference probabilities are as follows.

Indifference Probability (p)

Payoff Risk Avoider Risk Taker Risk Neutral

100 1.00 1.00 1.00

80 0.95 0.70 0.90

50 0.90 0.60 0.75

20 0.70 0.45 0.60

20 0.50 0.25 0.40

100 0.00 0.00 0.00

For the payoff of 20, what is the premium that the risk avoider will pay to avoid risk? What is

the premium that the risk taker will pay to have the opportunity of the high payoff?

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.