Page 67 -

P. 67

Trade Offs UNBUNDLING BUSINESS PATTERNS

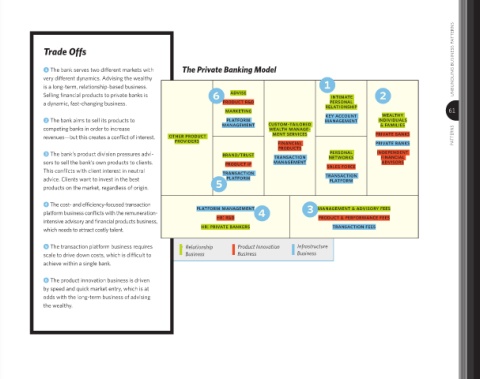

1 The bank serves two diΩerent markets with The Private Banking Model

very diΩerent dynamics. Advising the wealthy

is a long-term, relationship-based business. 1

Selling fi nancial products to private banks is 6 advise intimate 2

personal

a dynamic, fast-changing business. product r&d relationship

marketing wealthy 61

key account

platform

2 The bank aims to sell its products to management custom-tailored management individuals

& families

competing banks in order to increase wealth manage-

revenues—but this creates a confl ict of interest. other product ment services private banks PATTERNS

providers fi nancial private banks

products

personal

3 The bank’s product division pressures advi- brand/trust transaction networks independent

fi nancial

sors to sell the bank’s own products to clients. product ip management sales force advisors

This confl icts with client interest in neutral transaction

advice. Clients want to invest in the best platform transaction

platform

products on the market, regardless of origin. 5

4 The cost- and eΩiciency-focused transaction platform management management & advisory fees

platform business confl icts with the remuneration- hr: r&d 4 3 product & performance fees

intensive advisory and fi nancial products business,

which needs to attract costly talent. hr: private bankers transaction fees

5 The transaction platform business requires Relationship Product Innovation Infrastructure

scale to drive down costs, which is diΩicult to Business Business Business

achieve within a single bank.

6 The product innovation business is driven

by speed and quick market entry, which is at

odds with the long-term business of advising

the wealthy.

!"#$%&'(%)*+(%,,---/1 /012013---2455-67