Page 66 -

P. 66

UNBUNDLING BUSINESS MODELS Private Banking:

Three Businesses in One

60

Swiss private banking, the business of provid- Zurich-based private banking institution

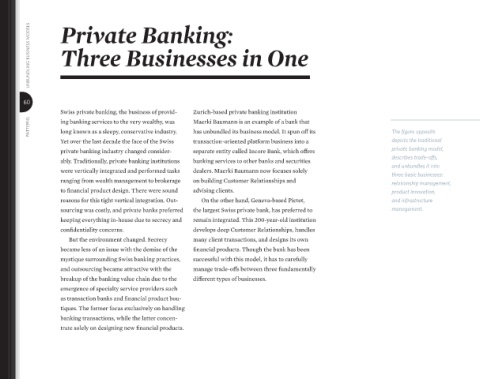

PATTERNS ing banking services to the very wealthy, was Maerki Baumann is an example of a bank that The fi gure opposite

long known as a sleepy, conservative industry.

has unbundled its business model. It spun oΩ its

Yet over the last decade the face of the Swiss transaction-oriented platform business into a depicts the traditional

private banking industry changed consider- separate entity called Incore Bank, which oΩers private banking model,

describes trade-oΩs,

ably. Traditionally, private banking institutions banking services to other banks and securities

and unbundles it into

were vertically integrated and performed tasks dealers. Maerki Baumann now focuses solely

three basic businesses:

ranging from wealth management to brokerage on building Customer Relationships and relationship management,

to fi nancial product design. There were sound advising clients. product innovation,

reasons for this tight vertical integration. Out- On the other hand, Geneva-based Pictet, and infrastructure

sourcing was costly, and private banks preferred the largest Swiss private bank, has preferred to management.

keeping everything in-house due to secrecy and remain integrated. This 200-year-old institution

confi dentiality concerns. develops deep Customer Relationships, handles

But the environment changed. Secrecy many client transactions, and designs its own

became less of an issue with the demise of the fi nancial products. Though the bank has been

mystique surrounding Swiss banking practices, successful with this model, it has to carefully

and outsourcing became attractive with the manage trade-oΩs between three fundamentally

breakup of the banking value chain due to the diΩerent types of businesses.

emergence of specialty service providers such

as transaction banks and fi nancial product bou-

tiques. The former focus exclusively on handling

banking transactions, while the latter concen-

trate solely on designing new fi nancial products.

!"#$%&'(%)*+(%,,---/3 /012013---2455-67