Page 580 - Sensors and Control Systems in Manufacturing

P. 580

Economic and Social Inter ests in the Workplace

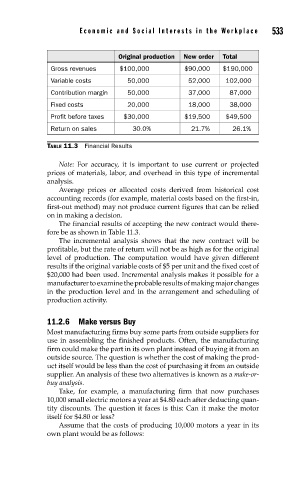

Original production New order Total 533

Gross revenues $100,000 $90,000 $190,000

Variable costs 50,000 52,000 102,000

Contribution margin 50,000 37,000 87,000

Fixed costs 20,000 18,000 38,000

Profit before taxes $30,000 $19,500 $49,500

Return on sales 30.0% 21.7% 26.1%

TABLE 11.3 Financial Results

Note: For accuracy, it is important to use current or projected

prices of materials, labor, and overhead in this type of incremental

analysis.

Average prices or allocated costs derived from historical cost

accounting records (for example, material costs based on the first-in,

first-out method) may not produce current figures that can be relied

on in making a decision.

The financial results of accepting the new contract would there-

fore be as shown in Table 11.3.

The incremental analysis shows that the new contract will be

profitable, but the rate of return will not be as high as for the original

level of production. The computation would have given different

results if the original variable costs of $5 per unit and the fixed cost of

$20,000 had been used. Incremental analysis makes it possible for a

manufacturer to examine the probable results of making major changes

in the production level and in the arrangement and scheduling of

production activity.

11.2.6 Make versus Buy

Most manufacturing firms buy some parts from outside suppliers for

use in assembling the finished products. Often, the manufacturing

firm could make the part in its own plant instead of buying it from an

outside source. The question is whether the cost of making the prod-

uct itself would be less than the cost of purchasing it from an outside

supplier. An analysis of these two alternatives is known as a make-or-

buy analysis.

Take, for example, a manufacturing firm that now purchases

10,000 small electric motors a year at $4.80 each after deducting quan-

tity discounts. The question it faces is this: Can it make the motor

itself for $4.80 or less?

Assume that the costs of producing 10,000 motors a year in its

own plant would be as follows: