Page 581 - Sensors and Control Systems in Manufacturing

P. 581

534

Cha p te r

Ele v e n

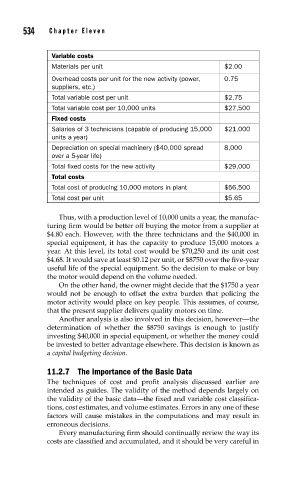

Variable costs

Materials per unit $2.00

Overhead costs per unit for the new activity (power, 0.75

suppliers, etc.)

Total variable cost per unit $2.75

Total variable cost per 10,000 units $27,500

Fixed costs

Salaries of 3 technicians (capable of producing 15,000 $21,000

units a year)

Depreciation on special machinery ($40,000 spread 8,000

over a 5-year life)

Total fixed costs for the new activity $29,000

Total costs

Total cost of producing 10,000 motors in plant $56,500

Total cost per unit $5.65

Thus, with a production level of 10,000 units a year, the manufac-

turing firm would be better off buying the motor from a supplier at

$4.80 each. However, with the three technicians and the $40,000 in

special equipment, it has the capacity to produce 15,000 motors a

year. At this level, its total cost would be $70,250 and its unit cost

$4.68. It would save at least $0.12 per unit, or $8750 over the five-year

useful life of the special equipment. So the decision to make or buy

the motor would depend on the volume needed.

On the other hand, the owner might decide that the $1750 a year

would not be enough to offset the extra burden that policing the

motor activity would place on key people. This assumes, of course,

that the present supplier delivers quality motors on time.

Another analysis is also involved in this decision, however—the

determination of whether the $8750 savings is enough to justify

investing $40,000 in special equipment, or whether the money could

be invested to better advantage elsewhere. This decision is known as

a capital budgeting decision.

11.2.7 The Importance of the Basic Data

The techniques of cost and profit analysis discussed earlier are

intended as guides. The validity of the method depends largely on

the validity of the basic data—the fixed and variable cost classifica-

tions, cost estimates, and volume estimates. Errors in any one of these

factors will cause mistakes in the computations and may result in

erroneous decisions.

Every manufacturing firm should continually review the way its

costs are classified and accumulated, and it should be very careful in