Page 456 -

P. 456

52 JOSEPH W. LEONARD

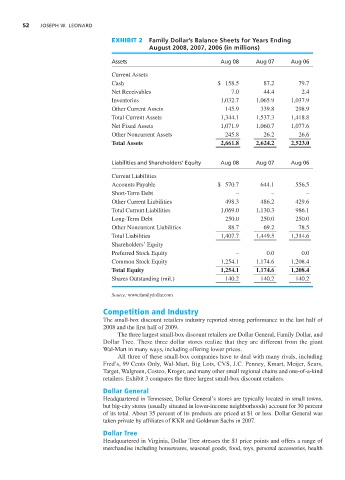

EXHIBIT 2 Family Dollar’s Balance Sheets for Years Ending

August 2008, 2007, 2006 (in millions)

Assets Aug 08 Aug 07 Aug 06

Current Assets

Cash $ 158.5 87.2 79.7

Net Receivables 7.0 44.4 2.4

Inventories 1,032.7 1,065.9 1,037.9

Other Current Assets 145.9 339.8 298.9

Total Current Assets 1,344.1 1,537.3 1,418.8

Net Fixed Assets 1,071.9 1,060.7 1,077.6

Other Noncurrent Assets 245.8 26.2 26.6

Total Assets 2,661.8 2,624.2 2,523.0

Liabilities and Shareholders’ Equity Aug 08 Aug 07 Aug 06

Current Liabilities

Accounts Payable $ 570.7 644.1 556.5

Short-Term Debt – – –

Other Current Liabilities 498.3 486.2 429.6

Total Current Liabilities 1,069.0 1,130.3 986.1

Long-Term Debt 250.0 250.0 250.0

Other Noncurrent Liabilities 88.7 69.2 78.5

Total Liabilities 1,407.7 1,449.5 1,314.6

Shareholders’ Equity

Preferred Stock Equity – 0.0 0.0

Common Stock Equity 1,254.1 1,174.6 1,208.4

Total Equity 1,254.1 1,174.6 1,208.4

Shares Outstanding (mil.) 140.2 140.2 140.2

Source: www.familydollar.com

Competition and Industry

The small-box discount retailers industry reported strong performance in the last half of

2008 and the first half of 2009.

The three largest small-box discount retailers are Dollar General, Family Dollar, and

Dollar Tree. These three dollar stores realize that they are different from the giant

Wal-Mart in many ways, including offering lower prices.

All three of these small-box companies have to deal with many rivals, including

Fred’s, 99 Cents Only, Wal-Mart, Big Lots, CVS, J.C. Penney, Kmart, Meijer, Sears,

Target, Walgreen, Costco, Kroger, and many other small regional chains and one-of-a-kind

retailers. Exhibit 3 compares the three largest small-box discount retailers.

Dollar General

Headquartered in Tennessee, Dollar General’s stores are typically located in small towns,

but big-city stores (usually situated in lower-income neighborhoods) account for 30 percent

of its total. About 35 percent of its products are priced at $1 or less. Dollar General was

taken private by affiliates of KKR and Goldman Sachs in 2007.

Dollar Tree

Headquartered in Virginia, Dollar Tree stresses the $1 price points and offers a range of

merchandise including housewares, seasonal goods, food, toys, personal accessories, health