Page 523 -

P. 523

RISK ANALYSIS 503

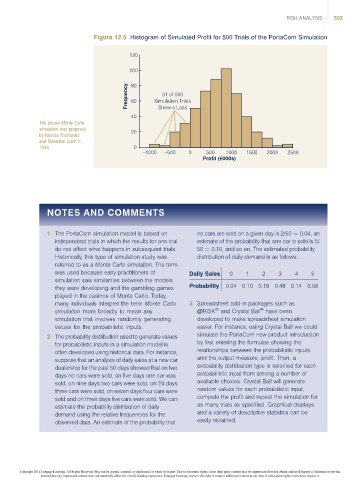

Figure 12.5 Histogram of Simulated Profit for 500 Trials of the PortaCom Simulation

120

100

Frequency 80 Simulation Trials

51 of 500

60

40 Show a Loss

The phrase Monte Carlo

simulation was proposed 20

by Nicolas Metropolis

and Stanislaw Ulam in

1949. 0

1000 500 0 500 1000 1500 2000 2500

Profit (€000s)

NOTES AND COMMENTS

1 The PortaCom simulation model is based on no cars are sold on a given day is 2/50 ¼ 0.04, an

independent trials in which the results for one trial estimate of the probability that one car is sold is 5/

do not affect what happens in subsequent trials. 50 ¼ 0.10, and so on. The estimated probability

Historically, this type of simulation study was distribution of daily demand is as follows:

referred to as a Monte Carlo simulation. The term

was used because early practitioners of Daily Sales 0 1 2 3 4 5

simulation saw similarities between the models

they were developing and the gambling games Probability 0.04 0.10 0.18 0.48 0.14 0.06

played in the casinos of Monte Carlo. Today,

many individuals interpret the term Monte Carlo 3 Spreadsheet add-in packages such as

Ò

Ò

simulation more broadly to mean any @RISK and Crystal Ball have been

simulation that involves randomly generating developed to make spreadsheet simulation

values for the probabilistic inputs. easier. For instance, using Crystal Ball we could

2 The probability distribution used to generate values simulate the PortaCom new product introduction

for probabilistic inputs in a simulation model is by first entering the formulae showing the

often developed using historical data. For instance, relationships between the probabilistic inputs

suppose that an analysis of daily sales at a new car and the output measure, profit. Then, a

dealership for the past 50 days showed that on two probability distribution type is selected for each

days no cars were sold, on five days one car was probabilistic input from among a number of

sold, on nine days two cars were sold, on 24 days available choices. Crystal Ball will generate

three cars were sold, on seven days four cars were random values for each probabilistic input,

compute the profit and repeat the simulation for

sold and on three days five cars were sold. We can

as many trials as specified. Graphical displays

estimate the probability distribution of daily

and a variety of descriptive statistics can be

demand using the relative frequencies for the

easily obtained.

observed data. An estimate of the probability that

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.