Page 583 -

P. 583

DECISION ANALYSIS WITH SAMPLE INFORMATION 563

MANAGEMENT SCIENCE IN ACTION

New Drug Decision Analysis at Bayer Pharmaceuticals

rug development requires substantial investment Probability assessments were made concerning

D and is very risky. It can take 15 years to research both the technical risk and market risk at each stage

and develop a new drug. The Bayer Biological Prod- of the process. The resulting sequential decision tree

ucts (BP) group used decision analysis to evaluate the had 1955 possible paths that led to different net

potential for a new blood-clot-busting drug. Six key present value outcomes. Cost inputs, judgements of

yes-or-no decision nodes were identified: (1) begin potential outcomes and the assignment of probabil-

preclinical development, (2) begin testing in humans, ities helped evaluate the project’s potential contribu-

(3) continue development into phase 3, (4) continue tion. Sensitivity analysis was used to identify key var-

development into phase 4, (5) file a licence application iables that would require special attention by the

with the FDA and (6) launch the new drug into the project team and management during the drug devel-

marketplace. More than 50 chance nodes appeared opment process. Application of decision analysis

in the influence diagram. The chance nodes showed principles allowed Bayer to make good decisions

how uncertainties – related to factors such as direct about how to develop and market the new drug.

labour costs, process development costs, market

Based on Jeffrey S. Stonebraker, ‘How Bayer Makes Decisions to

share, tax rate and pricing – affected the outcome.

Develop New Drugs’, Interfaces, no. 6 (November/December 2002):

Net present value provided the consequence and the 77–90.

decision-making criterion.

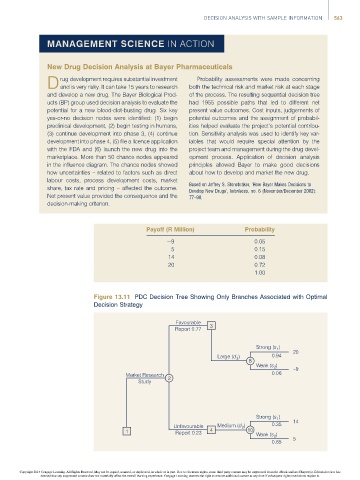

Payoff (R Million) Probability

9 0.05

5 0.15

14 0.08

20 0.72

1.00

Figure 13.11 PDC Decision Tree Showing Only Branches Associated with Optimal

Decision Strategy

Favourable

Report 0.77 3

Strong (s 1 )

Large (d ) 0.94 20

3

8

Weak (s ) –9

2

Market Research 2 0.06

Study

)

Strong (s 1 14

Unfavourable Medium (d 2 ) 0.35

1 Report 0.23 4 10

Weak (s 2 ) 5

0.65

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.