Page 404 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 404

390 The Complete Guide to Executive Compensation

shows how this 50 percent division and 50 percent employee performance approach might be

utilized. Note that the performance rating is used to look up the appropriate bonus percentage

for that grade (see Table 7-31), but only half is used (since one-half has already been set aside

for division performance). The sum of these bonuses is $198,215, or $2,985 more than

allowable (i.e., $198,215 $195,230). Therefore, the awards are proportionately reduced by

the ratio of $195,230 to $198,215, or 0.9849. Adding the individually adjusted bonus to the

division bonus produces the total for each person. These could be rounded to the nearest

$100, if deemed appropriate to finalize the calculation, as long as the division total does not

exceed $390,460.

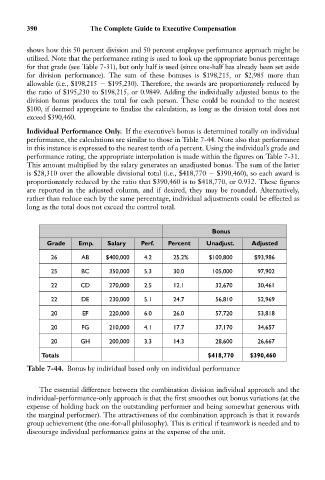

Individual Performance Only. If the executive’s bonus is determined totally on individual

performance, the calculations are similar to those in Table 7-44. Note also that performance

in this instance is expressed to the nearest tenth of a percent. Using the individual’s grade and

performance rating, the appropriate interpolation is made within the figures on Table 7-31.

This amount multiplied by the salary generates an unadjusted bonus. The sum of the latter

is $28,310 over the allowable divisional total (i.e., $418,770 $390,460), so each award is

proportionately reduced by the ratio that $390,460 is to $418,770, or 0.932. These figures

are reported in the adjusted column, and if desired, they may be rounded. Alternatively,

rather than reduce each by the same percentage, individual adjustments could be effected as

long as the total does not exceed the control total.

Bonus

Grade Emp. Salary Perf. Percent Unadjust. Adjusted

26 AB $400,000 4.2 25.2% $100,800 $93,986

25 BC 350,000 5.3 30.0 105,000 97,902

22 CD 270,000 2.5 12.1 32,670 30,461

22 DE 230,000 5.1 24.7 56,810 52,969

20 EF 220,000 6.0 26.0 57,720 53,818

20 FG 210,000 4.1 17.7 37,170 34,657

20 GH 200,000 3.3 14.3 28,600 26,667

Totals $418,770 $390,460

Table 7-44. Bonus by individual based only on individual performance

The essential difference between the combination division individual approach and the

individual-performance-only approach is that the first smoothes out bonus variations (at the

expense of holding back on the outstanding performer and being somewhat generous with

the marginal performer). The attractiveness of the combination approach is that it rewards

group achievement (the one-for-all philosophy). This is critical if teamwork is needed and to

discourage individual performance gains at the expense of the unit.